Who is Superdough?

Superdough is a popular Malaysian entertainment brand that operates Breakout Escape Rooms and Hauntu Immersive Experiences. They offer unique, story-driven attractions that merge creativity, technology, and interactive design. With growing demand across online bookings and walk-ins, the team needed a payment solution that could handle high weekend traffic, multiple payment options, and seamless reconciliation.

The Challenge

The team initially used several different systems for FPX, cards, and wallets, but this fragmented setup caused major issues:

Manual reconciliation wasted hours every week. Finance had to cross-check payments from different platforms, delaying reports and settlements.

Failed payments, especially during peak weekends: As transaction volumes grew, payment delays and failures became more frequent. This directly impacted revenue, as every failed payment meant a lost booking.

Negative customer experiences: Customers faced friction at checkout, which created unnecessary frustration and reduced customer excitement.

Superdough needed a stable, all-in-one payment solution that could simplify reconciliation, reduce downtime, and scale alongside them.

The Solution

Superdough turned to Razorpay Curlec to bring reliability, automation, and control into their online payment process. With a single integration, the Razorpay Curlec Payment Gateway enabled:

One dashboard to manage all online payments: The integrated dashboard means online payments, refunds and reports can all be viewed in one place.

Real-time tracking and automation: All transactions can be viewed, tracked and controlled in real-time, giving business full control over online payments.

+90% Online Transaction Success Rate: Razorpay Curlec has a +90% online transaction success rate over multiple methods, whether it be Visa, Mastercard, FPX, GrabPay, Touch ‘n Go, or Boost.

Real-time support: Best-in-industry support from our local team means that any issues that arise get resolved quickly in real-time.

Fully compliant with Bank Negara: Regulated by Bank Negara Malaysia, Razorpay Curlec assures security, certification validity, and more, providing peace of mind and compliance.

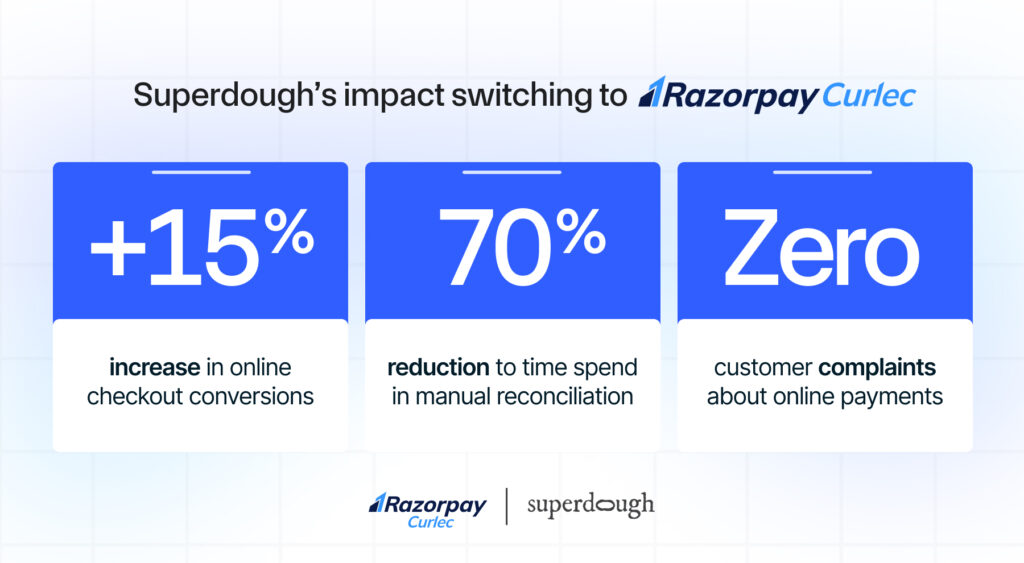

Key Results

Switching to Razorpay Curlec has helped allow Superdough to grow and scale with ease, with measurable results from both a payment and customer satisfaction perspective:

15% increase in online checkout conversions: More customers completed their bookings smoothly with Razorpay Curlec’s faster and more reliable checkout flow.

70% reduction in manual reconciliation: A unified dashboard streamlined payment tracking, cutting manual work and freeing up team capacity.

Zero customer complaints about payment delays or failures: Reliable transactions across all payment methods built trust and improved overall guest satisfaction.

Expanding business models with membership and subscription options: Automated recurring payments now enable new revenue streams through membership and loyalty programs.

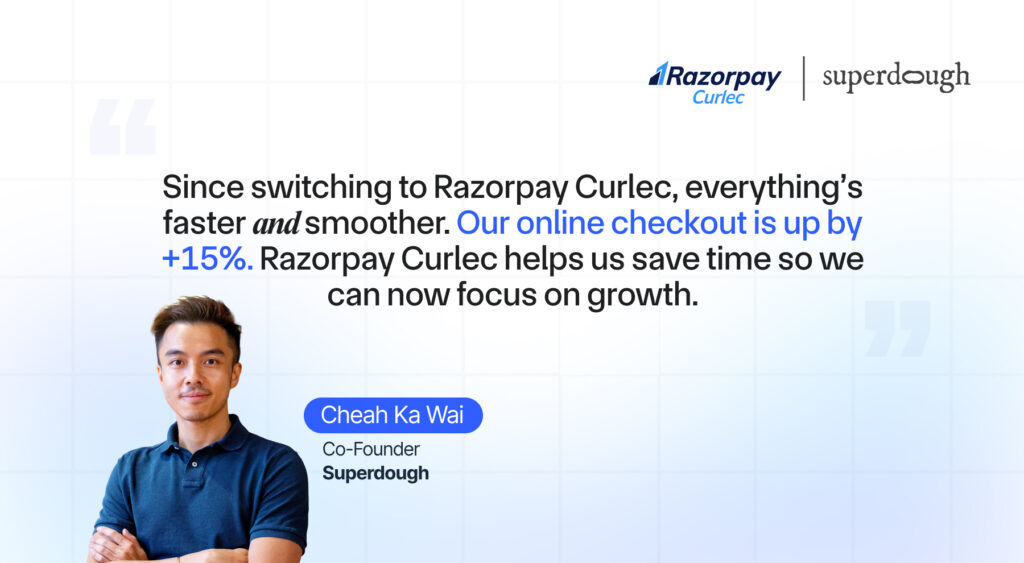

Ka Wai, Co-Founder of Superdough shared, “Since switching to Razorpay Curlec, everything’s faster and smoother. Our online checkout is up by 15%. Razorpay Curlec helps us save time so we can now focus on growth.

Ready to Turn Payments into a Stress-Free Experience?

Razorpay Curlec empowers Malaysian SMEs and Enterprises like Superdough to focus on growth and customer experience, while we focus on ensuring payments run smoothly.

Discover how your business can streamline payments today at curlec.com.

Ready to scale your business like Superdough? Sign up now.

Payment Gateway

Payment Gateway Payment Links

Payment Links Payment Pages

Payment Pages Payment Buttons

Payment Buttons Invoice

Invoice