Who is Wahed?

Wahed is a digital Shariah-compliant investing platform designed to create long-term wealth for its retail investors, without compromising their values. The company has gained over 400 thousand users worldwide by making halal investing accessible, easy, and affordable through providing a digital platform where users can easily select a professionally managed, diversified portfolio that aligns with their personal risk tolerance.

As a long-term investing platform, Wahed actively encourages clients to invest consistently, as their core belief is that passive investing works best when deposits happen regularly.

The Challenge

The primary challenge for Wahed was getting its clients to invest consistently over time. Before implementing Razorpay Curlec, recurring contributions were not automated. Users had to make deposits manually, which led to many forgetting or skipping contributions for the month. Staying consistent was difficult and required a lot of discipline.

The Solution

Using Razorpay Curlec completely changed the process for Wahed and its users, removing the biggest blocker. Once they started using Razorpay Curlec’s Subscription Feature, users were able to set up automatic weekly or monthly contributions one time and watch their wealth grow steadily, without any additional effort. The system automates the top-up weekly or monthly, making the investing process effortless and consistent.

Key features of the solution include:

- A Native Experience: The feature is fully integrated within the Wahed app and fits naturally within the user interface.

- Simplicity: There are no redirects or extra steps. Retail investors can set up automated investing in just a few taps.

- Operational Visibility: On the backend, the Razorpay Curlec dashboard gives Wahed’s team clear visibility into all recurring mandates and payments.

The automation simplified operations and made it easy for disciplined investing to become second nature for their retail investors.

Key Results

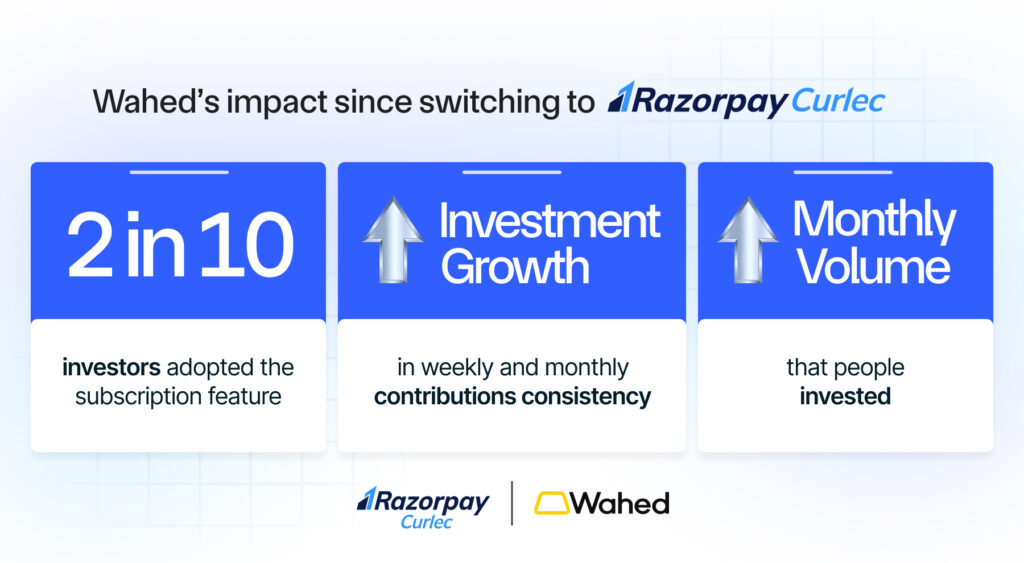

Since enabling recurring deposits through Razorpay Curlec, Wahed has seen a clear shift in client behavior and significant business improvements, both in terms of client experience and operational efficiency.

User-Facing Results:

- Improved consistency rates: The consistency rate for monthly contributions went up significantly. Today, nearly 2 in 10 active investors on Wahed use recurring deposits, and that number is growing fast.

- New Growth in Monthly Investment Volume: Monthly investing participation saw clear growth after automation went live.

- Easier for users to reach investment goals: The automated system helps clients stay on track with their goals without extra effort, making investing effortless, consistent, and aligned with their long-term goals.

Business & Operational Impact:

- Stronger Retention: Wahed now has stronger retention and more engaged retail investors.

- Predictable Inflows and Scalability: The automation provides predictable inflows, which allows for better forecasting, less volatility, and improved planning for scalability.

- Simplified Operations and Platform Reliability: The platform is reliable, stable, and easy to integrate, running quietly in the background while simplifying operations and reducing support requests.

As stated by Zayan Yassin, CEO of Wahed Malaysia, “Razorpay Curlec is smooth, simple and just works. Now retail investors just need to set up their automatic contributions once to start their investing journey. Investing becomes effortless and for Wahed, this means stronger retention and more engaged investors.”

Start Automating Your Payments

By removing friction from payments, Razorpay Curlec empowers Malaysian SMEs and Enterprises, including leading brands like Wahed, to focus on accelerating growth and enhancing customer satisfaction.

Discover how your business can streamline payments today or view our complete suite of payment tools at curlec.com.

Want to automate recurring payments and improve customer retention like Wahed? Sign up now.

Payment Gateway

Payment Gateway Payment Links

Payment Links Payment Pages

Payment Pages Payment Buttons

Payment Buttons Invoice

Invoice